Context for Chatgpt:

Despite the strong volatility caused by the Iranian-Israeli conflict, the Bitcoin course on Monday 23rd June increased significantly since the notice of a ceasefire between the two countries and revived the hope of a new bull phase for the crypto asset.

However, the upward trajectory of Bitcoins may have encountered certain obstacles, including the potential threat of trade war and the weight of historical market formulas.

Can bitcoin question the usual decrease in T3 in 2025?

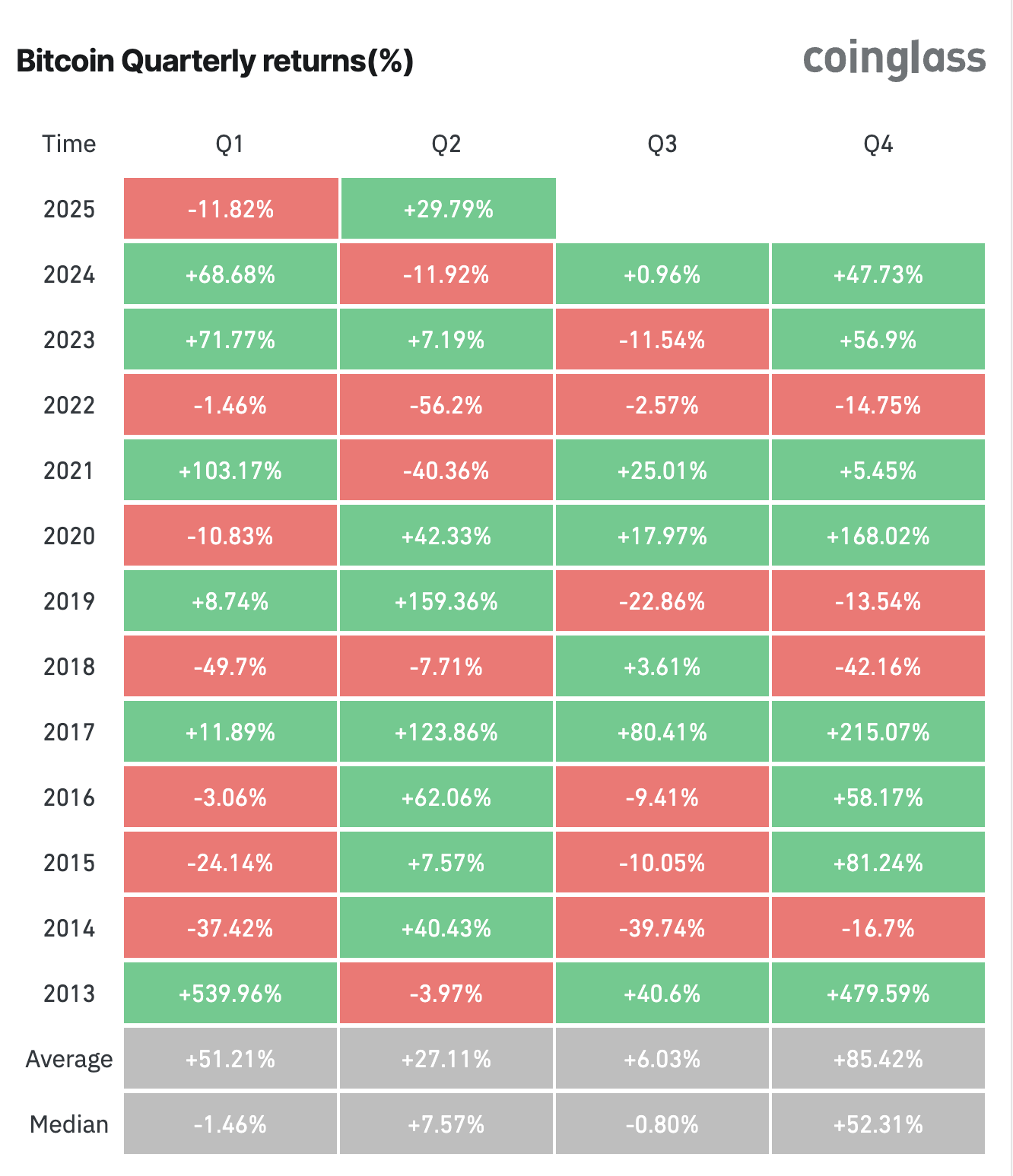

Coinglass’s data showed that although the bitcoin course had a decline in the beginning of the year, it straightened significantly in the second quarter. During this quarter, the BTC showed a yield of 29.79 %.

This meant one of its best quarterly performances since the second quarter of 2020, when Bitcoin recorded an increase of 42.33 %.

In addition, Bitcoin reached a historical summit in May by more than $ 111,900, which carried favorable macroeconomic factors and increases institutional acceptance. And although geopolitical tension caused a correction that caused the bitcoin passage below $ 100,000, the asset has remained resistant and has since gained most of its losses.

Indeed, the data beincrypto showed that when writing this message, the bitcoin course was $ 107,383, reflecting an increase of 3 % last week. While the second quarter ends, all eyes have now turned into the performance of bitcoins in the next quarter.

Historically, the third quarter was the lowest for bitcoins, with an average yield of only 6.03 %. Despite this, market observers have different views on potential bitcoin performance in the coming months.

In a recent post on X analyst Ether Wizz stressed that the bitcoin volume of cash is growing. He noted that a similar diagram was observed in the third quarter of 2024, which led to the price rally.

“I think the new ATH for BTC is now only a matter of weeks,” he said.

On the other hand, Benjamin Cowen, CEO of the company to Kryptov, predicted that Bitcoin could reach his next cavity around August or September. This suggests a more cautious perspective for the coming months.

“Bitcoin would probably begin to show signs of weakness around mid -June, while the weakness of the third quarter will begin to manifest. The same has happened in recent years,” Cowen wrote.

3 macroeconomic forces that could determine the bitcoin fate in T3

While the prospects of bitcoins remain discussed, several future macroeconomic events and factors could affect its trajectory in the third quarter of 2025. The first key event is the decrease in the early federal reserve system.

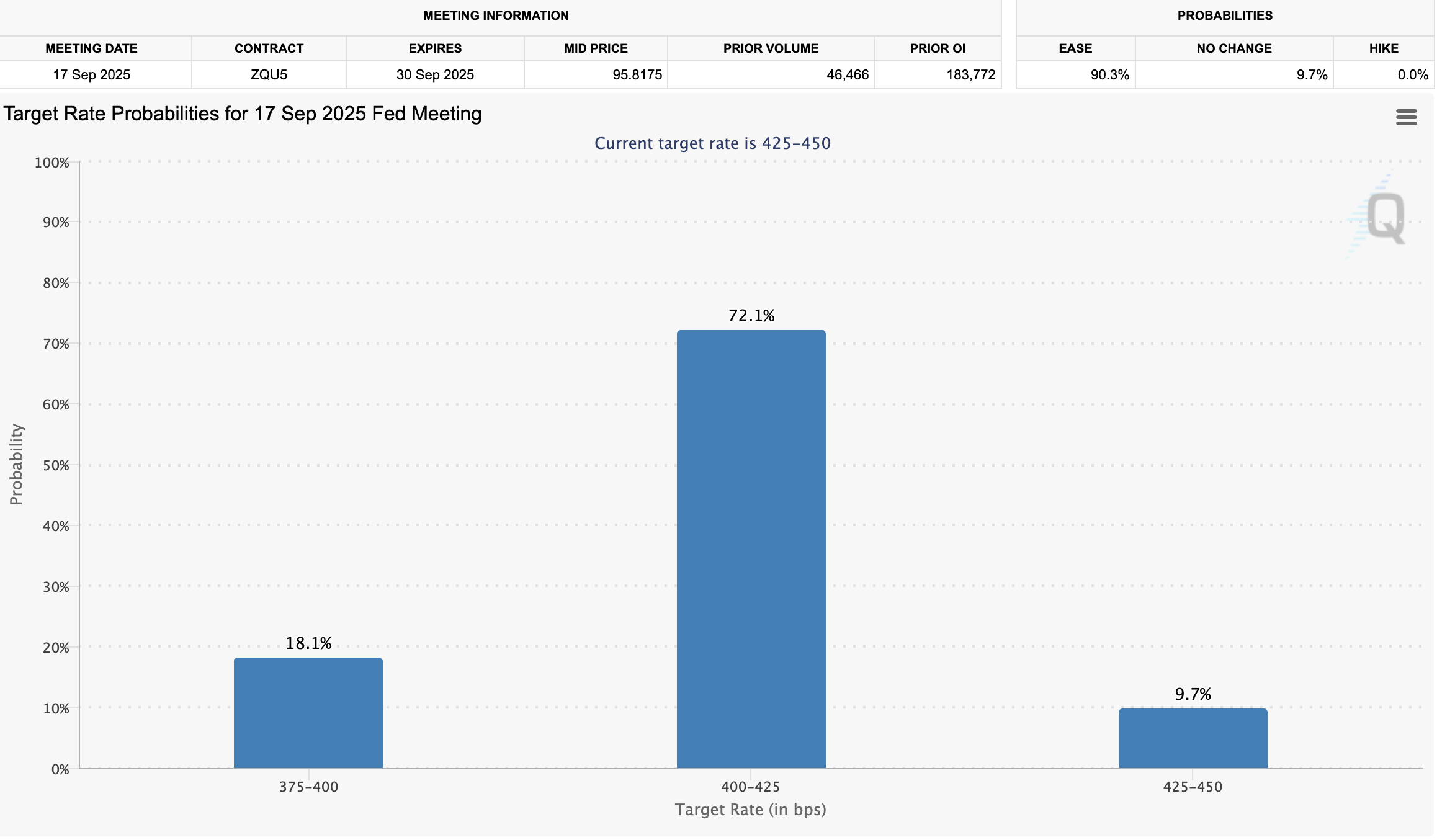

According to CME Fedwatch, while only 20.7 % of market participants expect the federal reserve system to reduce interest rates in July, the probability reached 90.3 % per month of September.

This radical change in anticipation reflects the growing trust that the Fed will finally soften its monetary policy in the third quarter of the year. This could be a significant bull engine for crypto markets, especially bitcoins.

In addition, the currency weight of M2 should continue to increase in the third quarter. According to Abbot’s analyst, China’s popular cataract, he has been in the economy of 1.5 trillion Yuan this week into the economy.

This initiative, which is part of the general efforts to stimulate economic growth, could lead to greater liquidity on the market. This can, in turn, stimulate the demand for assets such as bitcoins, while investors are looking for alternatives in the expanding money supply context.

“The main reason is the decline in Doxy, which allows other countries to print more without being afraid of their currency devaluation. All this pushes the global supply of M2 into new heights, which means that the Bitcoins increase is even more important.

In parallel, the increase in US debt also places bitcoins as attractive coverage. This could therefore attract the interest of private institutions and investors looking for alternatives to traditional assets in the context of increasing financial uncertainty.

However, the expiration of the 90 -day Trump Awards is close to the opposite force.

“The freezing of 90 daily prizes of President Trump has only the remaining days only the remaining days.

The potential return of the trade war could therefore introduce volatility that historically was a problem for a bitcoin course. Indeed, the tension of the past trade has led to significant correction of prices. Thus, the new three -quarter trade war could probably undermine the positive effects of rates and cash supply.

Morality History: All Bitcoins T3 are not similar.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.