Context for Chatgpt: After dropping under $ 100,000 at the beginning of the week due to conflict in the Middle East, Bitcoin has finally gained the animal’s hair by announcing a ceasefire until it increases by more than $ 105,000.

Another problem is the remarkable change in the behavior of investors, which shows the fatigue of the Bitcoins market, which could prepare the ground for a decline in the course below $ 100,000.

Bitcoin’s profit slows down

During the previous market cycle (2020–2022), Bitcoin investors earned a total of approximately $ 550 billion in a few ralles, including two main waves. If we return to the current cycle, profits have already exceeded $ 650 billion, which exceeded the total number of previous cycle. This tells us that although important profits have been made, the market could enter the cooling phase.

The latest data therefore suggest that the use of the benefits has reached its peak, the market is now in the period of cooling after the third main wave of profits. Thus, although the profits were secured, it seems that the momentum that pushed bitcoins up was a couple. As profitability decreases, investors are changing, leading to a reduction in purchasing pressure.

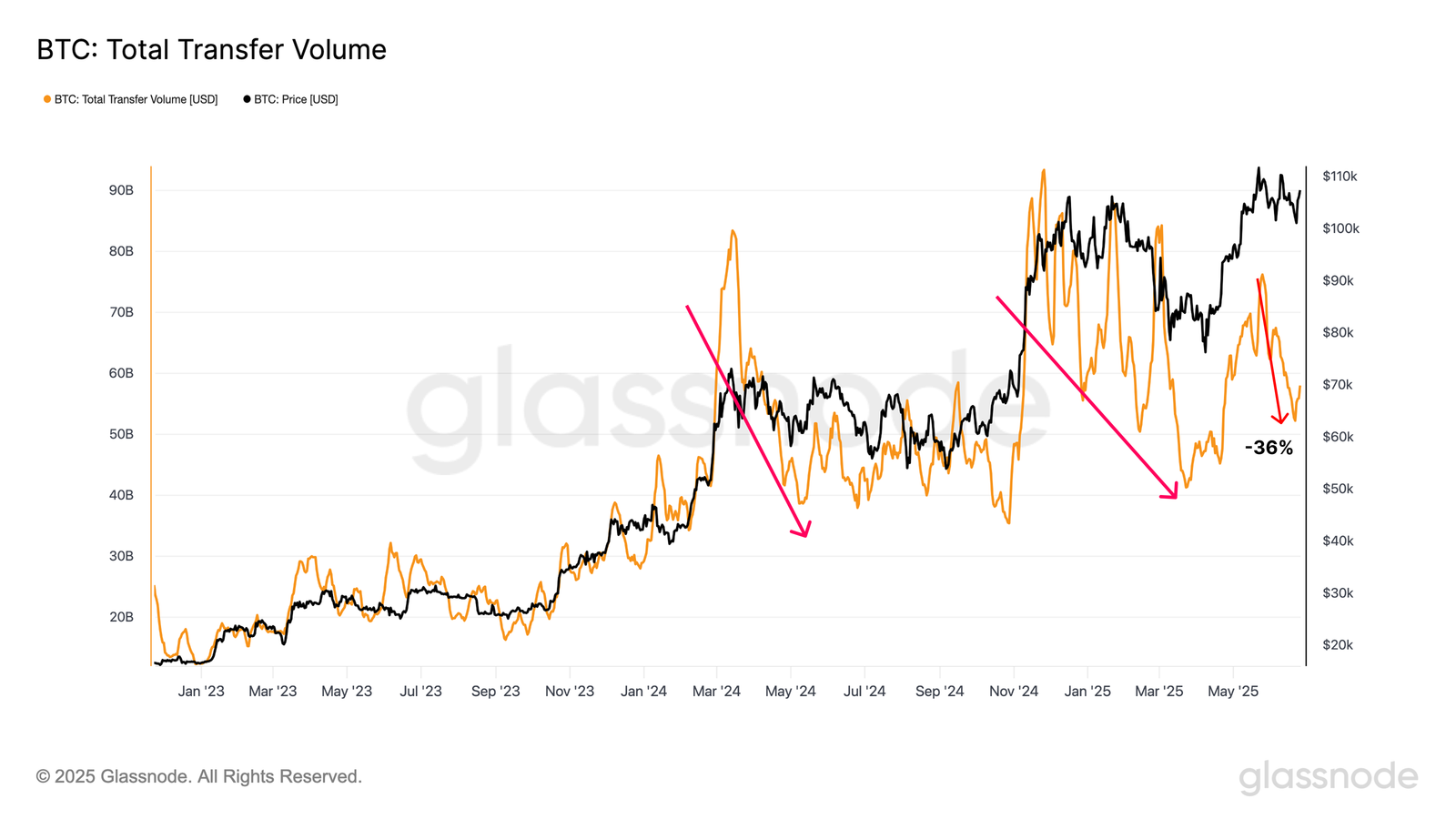

The total volume of bitcoin gears also shows signs of cooling. In fact, the 7 -day mobile diameter of gears on the chain actually fell by approximately 32 %, from the peak of $ 76 billion at the end of May last weekend to $ 52 billion. It has been shown that this decline is cohesive with a more general coolant scheme on the market, suggesting that Bullcoin could lose its strength.

Thus, slowing the volume of transfers reflects a general loss of activity through the main bitcoin indicators and strengthens the idea that market participants accept cautious access. As the market is released, the bitcoin course may be downwards.

The Bitcoin course must ensure support

The Bitcoin course is currently $ 106,907, just below $ 108,000. In order to continue its ascending trend, the BTC must convert $ 108,000 into support. This would open the way to new profits and push Bitcoins to $ 110,000 and potentially behind them. However, the current market feeling remains fragile.

Given the growing symptoms of fatigue on the market and cooling the main indicators of activity, therefore, it seems more likely to be in the short term. Therefore, if the application is revived, the bitcoin course could drop below $ 105,000 and test the critical support level of $ 100,000. Any other loss of momentum could cause a deeper decline.

On the other hand, if the Bitcoins course manages to stay above the key support level, the upward trend remains intact. If he managed to regenerate $ 108,000 as a medium, it would open up up to $ 110,000. A new breakthrough above this level could lead to a movement towards a historical record of $ 111,980, now bull momentum and investor optimism.

Morality of History: When Bitcoin Tires, you never know how long it takes to catch your breath.

Notification of irresponsibility

Notice of irresponsibility: In accordance with the Trust project Directives, this article for price analysis is intended only for information purposes and must not be considered financial or investment advice. Beincrypto undertakes to provide accurate and impartial information, but market conditions may change without prior notice. Always carry out your own research before making any financial decision and consult a professional.