Context for Chatgpt:

According to historical data, bull technical indicators and growing investors’ growth, the idea of a new upper step for the bitcoin market becomes stronger.

Why could July run another big rally bitcoins

Bitcoin currently has distortion with bias, it is now significantly above the threshold of $ 107,000. At the time of writing this article, the first Kryptos sold for $ 107,076, which is almost 50 % since April first.

While the BTC course is consolidated in the bull of the Luder scheme, the upward breakthrough could prove immediate. In fact, flags are tight areas of consolidation in prices (flag) and display the movement against temperature, which follows immediately after clean directional movement (flag mast) of the course.

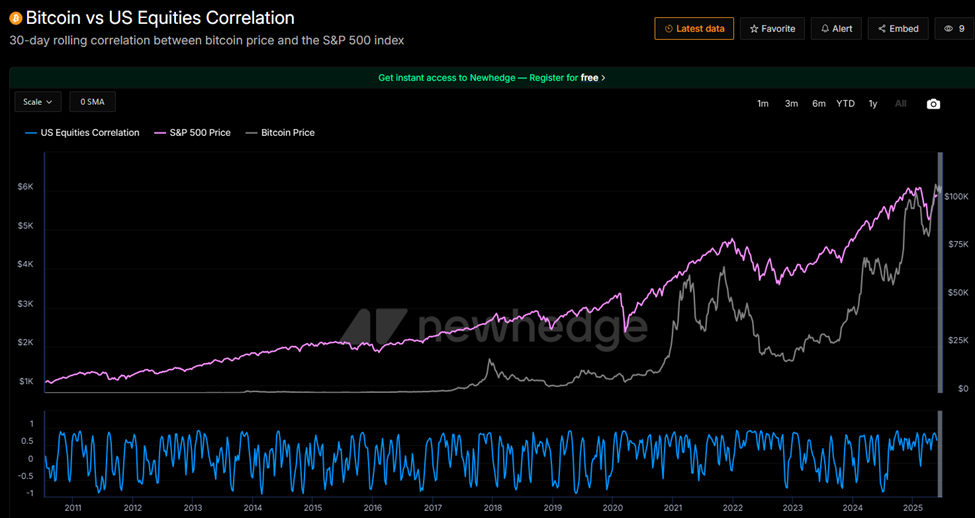

The User X (Twitter), Zerohdge, recently stressed that the S&P 500 has published positive profits every month in July in July. It is a remarkable performance with an average yield of approximately 2.3 % in the last two decades.

In July 2023, we will notice in particular +3.11 % and in July 2024 an increase of +1.13 %. Although the older decades as the 1970s and 1980s were less coherent due to macroeconomic turbulence, such as the 1987 oil crisis, in the last diagrams as a historically strong moon.

Based on this perspective, the correlation of bitcoins with the S&P 500 will place a pioneering crypto for one month of Bull July, at least if the story repeats.

Crypto Fella analyst also sees an increase in the potential and emphasizes that Bitcoin is preparing for a breakthrough while watching the S&P 500. This suggests convergence between traditional and digital markets.

“Bitcoins (IS) are about to unfold and in July they could match S&P for new historical heights,” he said.

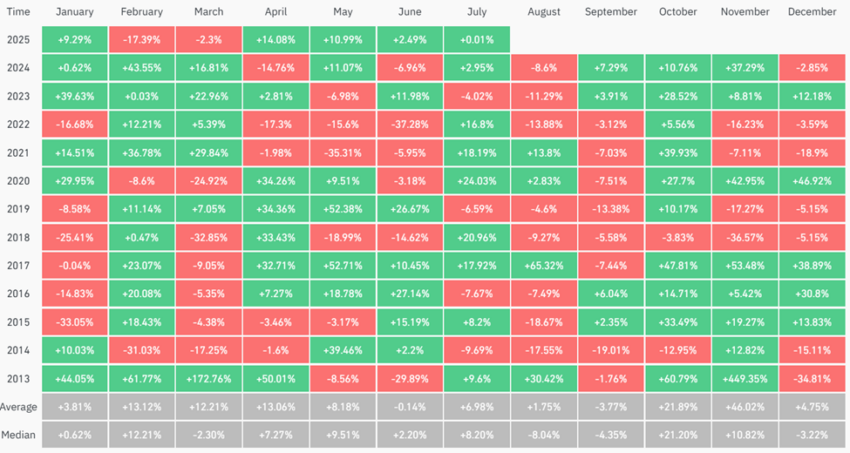

The crypto market really resonates with this seasonal wind, bitcoins also showed their strength in the summer.

“June was one of the strongest months in the history of Bitcoins,” said Formanite, merchants and crypto analyst.

From cleaning to Bull’s breakdown: Bull Market Signals

The chain data and feel that bitcoins could make money again for its seasonal dynamics. The Beincrypto team of English observes in particular Stablecoin indicators, suggesting that the bitcoin rally could be far from being completed.

The 0xnobler analyst in parallel that the market is now appearing from the final shock phase and entering a new ascending trend.

In this context, the analyst evokes a possible season of altcoins, but only for “promising small capitalization”. It emphasizes that successful traders focus on cyclic patterns formed by market psychology, regulatory changes and technological innovations.

Although past performances never guarantee future returns, the elements always appear to be bull on a month in July for events and crypto.

Thus, if history repeats itself, investors could see how Bitcoins lead a fee, followed by a selective altcoin rally, while capital turns into undervalued assets.

However, investors must always carry out their own research and combine optimism and caution. Makroeconomic changes and surprising catalysts can indeed disrupt even the strongest seasonal trends.

Morality History: Summer Bitcoin is never easy.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to check their own facts and consult a professional before you decide on the basis of this content.