Bitcoin lessons, such as Ethereum lessons, remained stable on Tuesday 1 July, despite the withdrawal from the whole market. However, Beincrypto analysis suggests that this bill, if adopted, could transform the feeling of investors and the capital contribution to the crypto market.

Bitcoin could win it as a tax coverage

The closest impact would directly concern Bitcoins. Indeed, the bill should increase state debt by more than $ 3 billion. Players on the market are already preparing for long -term inflation pressure.

Bitcoins, often perceived as protection against devaluation of trust currencies, could benefit from a revived request.

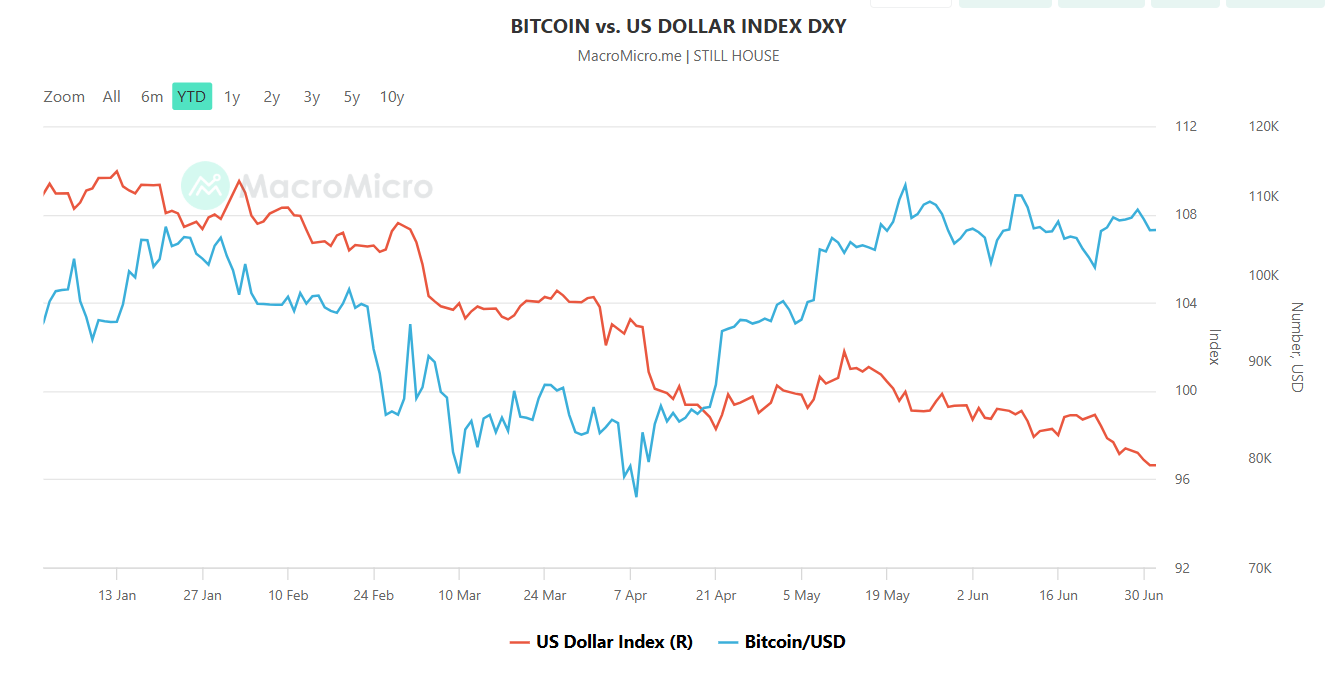

Most importantly, weakened dollar and declining trust in the United States fiscal administration would probably strengthen the topic of bitcoin role as “digital gold”.

Altcoins could show uneven profits

Ethereum and other large capitalization altcoins could also benefit from short -term support. Respiration risks outside obligations and alternative assets often stimulate the crypto market as a whole.

However, not all tokens are located in the same way. Indeed, infrastructure and infrastructure tokens could benefit from increasing activity and capital flows.

On the other hand, the same corners and speculative assets could remain volatile or insufficiently powerful.

Lighter tax rules, such as exceptions for small crypto transactions, could support wider adoption, especially among private users.

The feeling of private and institutional investors is likely to differ

Specific investors could positively respond to a decline in personal taxes and to simplify the crypto statement.

If the final bill involves tax reforms favorable to crypto, including minimis exceptions and clarifying dull income, this could reduce friction for small traders and defi users.

The institutional feeling could be more sensible. Rapid debt accumulation and a potentially inflationary perspective could lead institutional investors to accepting access -A -and especially if the federal reserve system stretches its policy in response.

Short -term perspectives: the crypto market could increase

If the chamber adopts the bill with intact cryptovios, bitcoin and Ethereum, they could start another assembly. The rotation of capital over the accounts of the Ministry of Finance, motivated by an increase in US debt and tax insecurity, could increase prices.

The total capacity of the market crypto could test a range of $ 3.5 to 3.7 billion short -term dollars.

However, the scope of the assembly will depend on the wider macroeconomic conditions, including the policy of interest rates, the application of regulations and global liquidity trends.

Medium -term perspectives: Fed policy will be key

The long -term impact on crypto depends on the reaction of the federal reserve system on the inflationary effects of the law.

If the Fed raises interest rates to face tax expansion, it could strengthen the dollar and put pressure on crypto markets. Conversely, if the Fed remains helpful, digital assets could continue to benefit from it.

The survival of cryptological provisions of the bill will also be essential. If the measurement measures are removed or irrigated in the room version, the industry could face new obstacles.

Conclusion

Trump’s Senate “Big Beautiful Bill” is the main change of tax.

If the bill is approved by the Chamber, crypto assets, especially bitcoins, can benefit from increasing tax concerns and investors’ desire for alternative protection.

However, volatility remains a risk. Fed policy, inflation and legislative negotiations will determine the sustainability of any crypto rally.

Morality of History: The crypto never closes the eyes on the United States.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.