In parallel, the cloud structures of ichimoku and EMA diameters show lower, with keys resistance levels that remain solid and the support areas are now in danger. Without immediate turnover on the Solana side, the pressure could be down in the short term.

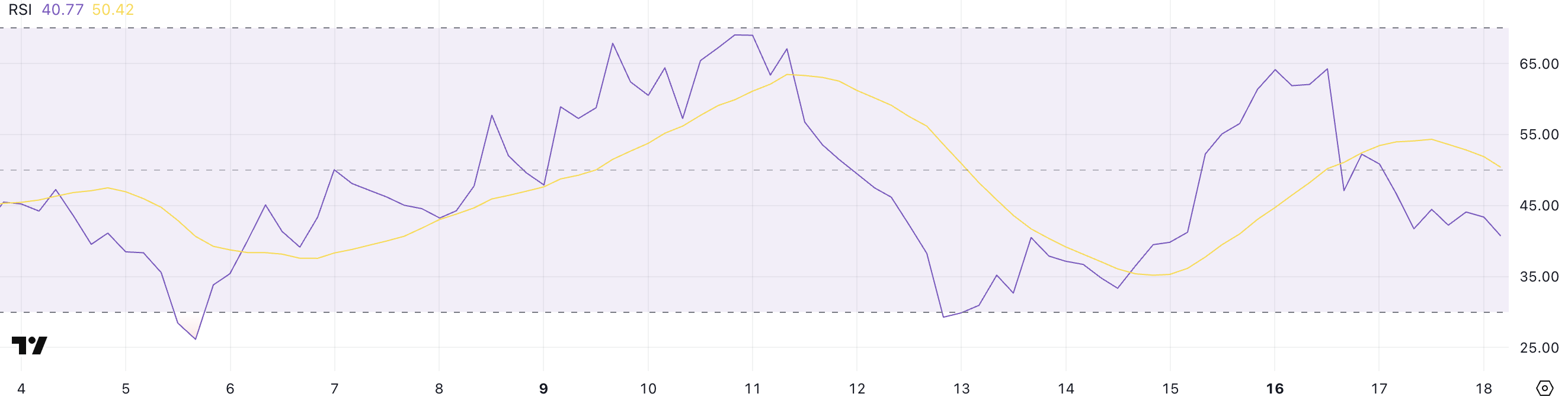

Solan’s RSI passes to 45 while the momentum disappears

The Relative Force Index Solana (RSI) dropped to 40.77. This is a remarkable decline in relation to the result of 64.25 only two days ago.

This brutal change clearly reflects the weakening of dynamics up and suggests that recent sales pressure has exceeded the interest in buying.

The decline points to a potential transition from neutral or boring conditions to a more cautious or even lower area. Especially because traders re -evoke their short -term perspectives of Solana.

As a reminder, RSI is a widely used momentum indicator that measures the speed and range of recent price changes. It differs from 0 to 100, with deductions above 70 generally show the conditions of excess rocket. Very often after passing over 70 years is expected to withdraw. Conversely, when values are less than 30, the price jump is highly expected.

Reading almost 40.77 The placement of Solana in a neutral area near the occurrence, indicating that the asset loses its bull dynamics. However, the occurrence has not yet occurred and could cause damage.

If RSI continued, this could pose a risk of further decline, while stabilization over 40 could propose consolidation before the decision to further move to be performed.

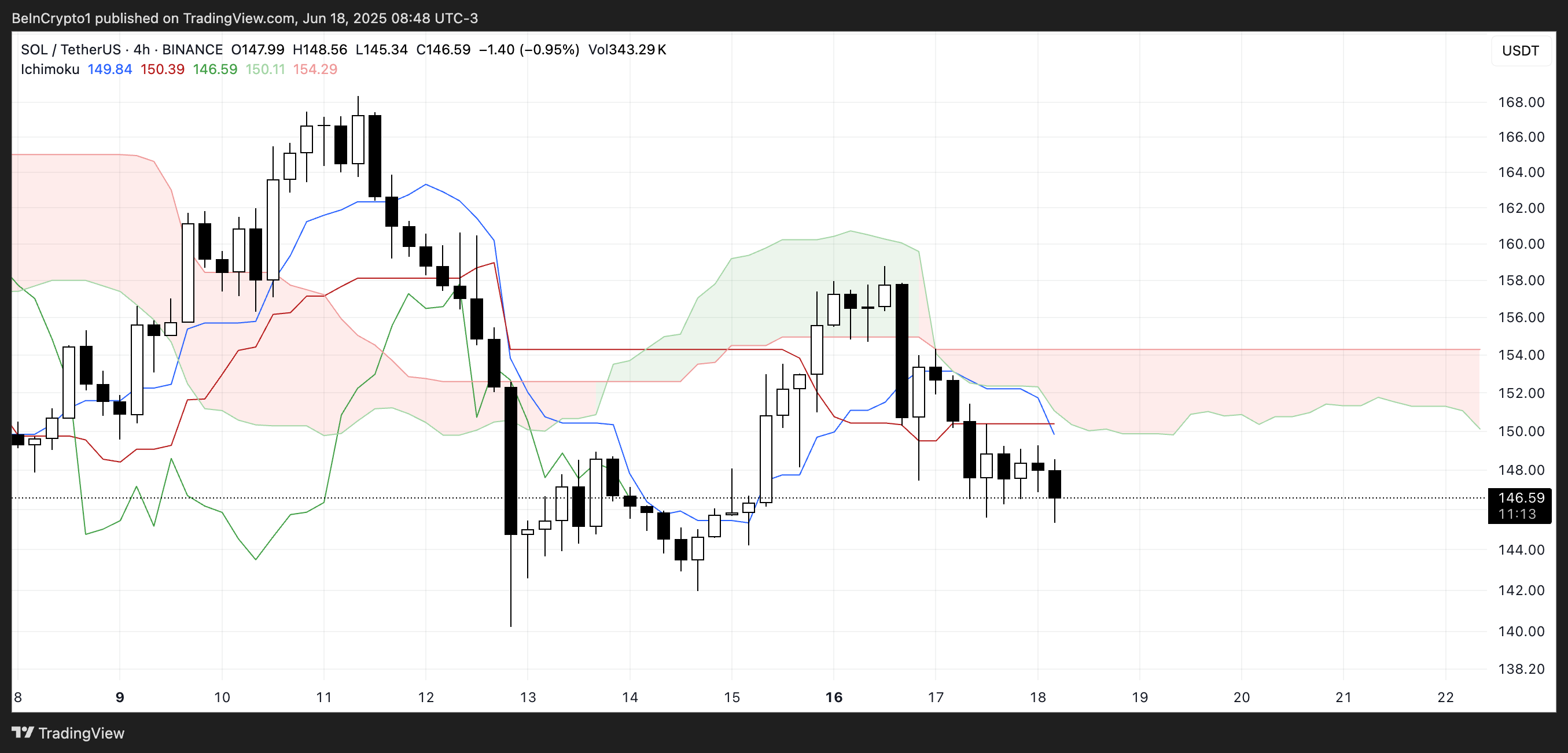

Ichimoku cloud keeps the floor under pressure

The Solany Ichimoku cloud graphics reveal Downstream configuration. The price event is currently under Kumo (cloud), which is overshadowed in red.

This red cloud refers to the predominant dynamics down and acts as resistance. The leading span A (green line forming the upper edge of the cloud) remains under the front span B (the red line forms the lower edge) and strengthens the bear structure.

The upcoming cloud is also red and relatively strong, indicating the strong resistance to come. Unfortunately, the bull conversion is much more difficult.

The thin (blue line) is currently under Kijun (red line): another classic reduced signal. These two lines also flattened, rather signaling consolidation rather than strong directional movement.

With candles that try to overcome thin, short -term dynamics seem weak.

If there is no bull crossing or prices penetrating the cloud, Solana remains under pressure if you trust his cloud ichimoku.

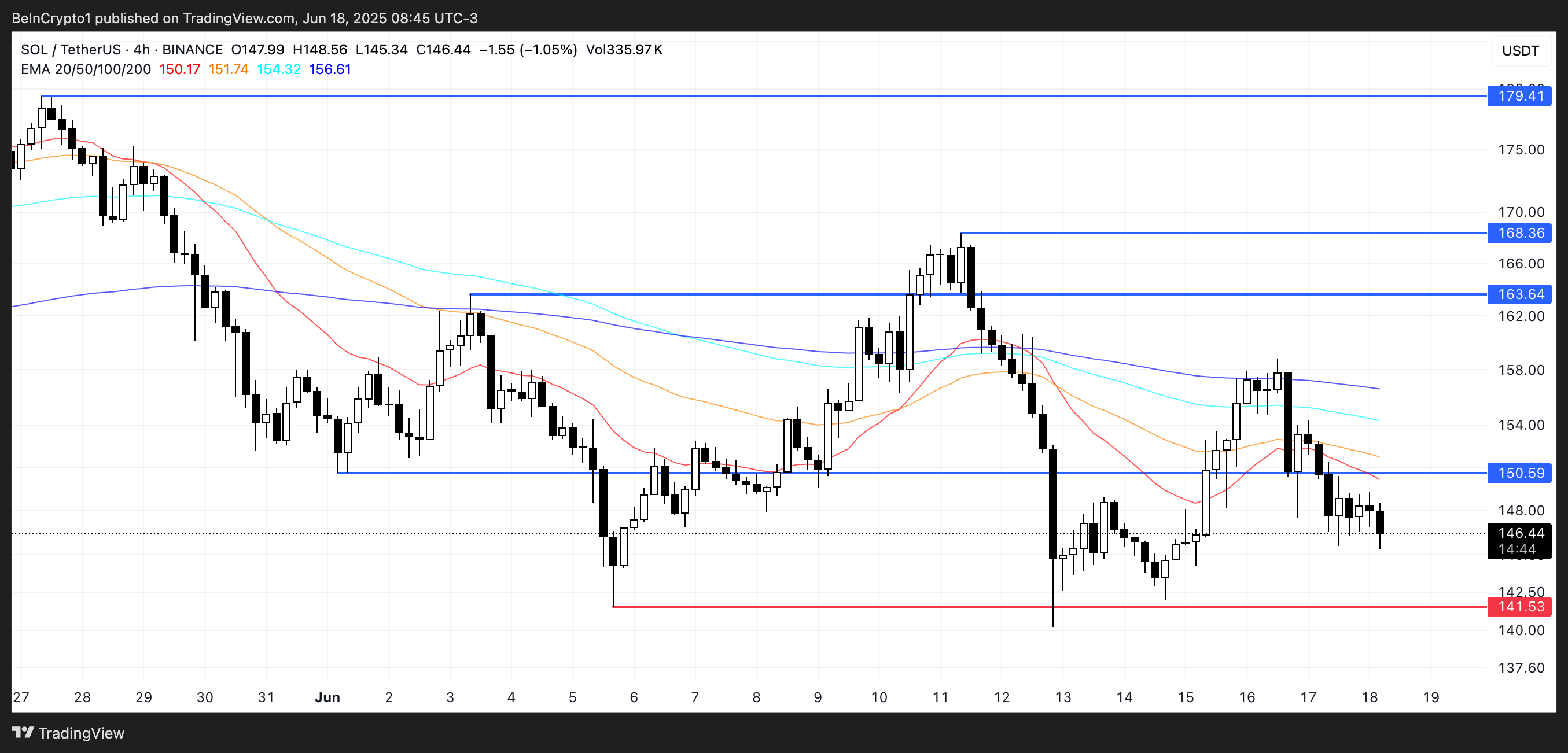

The EMA structure remains lower

The Ema Solan structure remains down, with shorter mobile diameters located under a longer period of time, indicating that dynamics are lower.

This configuration appeared after the last attempt to overtake bulls that failed two days ago. In fact, because the land tried to reverse the trend, but faced rejection. If the alignment is maintained, the asset could test the immediate level of support to $ 141.53.

A break below this level could open a way to a further decline and potentially push the soil below $ 140 for the first time since April 21.

Conversely, if the trend is perverted and short -term EMA begins to straighten, Solana could re -test the resistance zone around $ 150.59. Solana, which is shown up, Solan could re -test the resistance area around $ 150.59.

A clear breakthrough above this level would be the first sign of potential trend change. If the purchase dynamics are strengthened at this point, other goals are placed at $ 163.64 and $ 168.36.

In the case of an extended rally, the soil could even target $ 179.41 as another main bull’s goal.

Morality of History: After the neck is tilted towards the decline, solan with torticollis.

Notification of irresponsibility

Notice of irresponsibility: In accordance with the Trust project Directives, this article for price analysis is intended only for information purposes and must not be considered financial or investment advice. Beincrypto undertakes to provide accurate and impartial information, but market conditions may change without prior notice. Always carry out your own research before making any financial decision and consult a professional.