Bitcoin cash cryptocurrency (BCH) is distinguished as a special case on the market. Its price increased regularly, although it was very little mentioned and was not included in strategic reserves at all. The project did not know any recent major development and experts do not comment on it.

Bitcoin cash breaks Records based on discretion

According to Tradingview, the price of BCH increased for three months, from $ 253 to more than $ 489. This represents an increase of 98 %in a limited time. With this increase BCH exceeded the SU and the reference to increase the market capitalization to the 12th place.

At one point, Bitcoin could even exceed $ 500, which officially created a new summit for 2025. Very few altcoins created this kind of fitness due to the winter of the persistent altcoins.

At the same time, the dominance of bitcoin cash increased from 0.2 % in March to 0.3 % in June, suggesting that capital accumulates in bulk into BCH.

In addition, LunarCrush data shows that BCH social activity in 2025 reached its highest level. This indicator measures the frequency to which BCH is mentioned in social networking discussions.

Google Trends also confirms this. Research on the keyword “Bitcoin Cash” has actually achieved a score of 100 20 June, the maximum level in the last 90 days.

Another sign of growing interest is the volume of BCH transactions. According to Coinmarketcap, the volume of daily transactions increased from $ 200 million at the beginning of the month to more than $ 700 million.

This data clearly shows that interest is very real for BCH cryptocurrency with investors who respond to the presence. Recent Beincrypto analysis even ensures a potential increase in the course over $ 500 or even $ 550.

What supports this increase?

Some investors are recorded by the BCH price dynamics. This altcoin did not use the same institutional attention as names such as land, xRP or hyperliquide, but the increase is still very present.

Bitcoin cash is also missing dynamics in his community. His last main update took place more than a month ago. However, the distribution of BCH offers has some advantages. He shares similarities to the similarity of bitcoins.

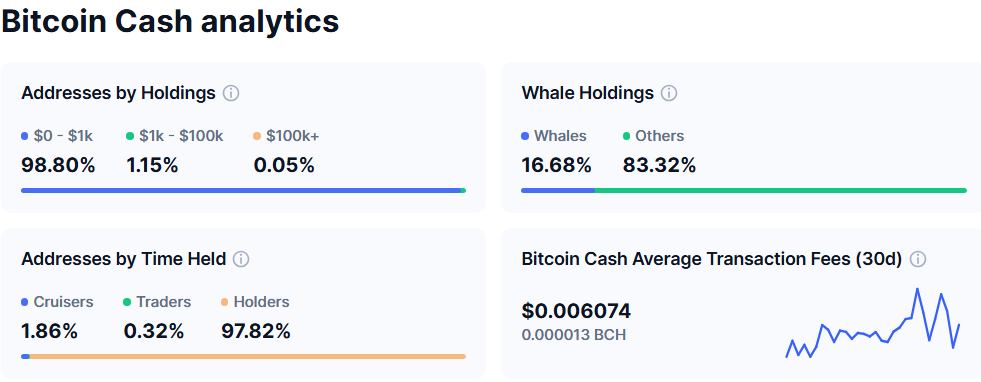

Coinmarketcap data shows that BCH has a fixed offer of 19.8 million already in circulation. In addition, BCH offers low transaction costs. The user demand remains stable, with an average of more than 53,000 transactions a day.

In addition, more than 97 % of wallets are held by long -term holders who have maintained their chips for more than a year. The ratio of the wallet (wallet with more than 1 % of the offer) is approximately 17 %. Together, these factors support the positive dynamics of long -term supply and demand.

“(BCH has climbed) because it is a higher upgrade to bitcoins and maximists can no longer contain it. Why buy a BTC for $ 100,000 when you can get a BCH for $ 500? Both have the same limited offer and use the same algorithm, with BCH, which actually has a larger block size,” commented X.

The question is now whether this trend can be maintained in the long term for this cryptocurrency or whether it is only a temporary price increase. Although it almost doubled in three months, BCH remains significantly below the historic summit of $ 1,600 in 2021. While the BTC signed several new ATHs in 2024 and 2025.

Morality of the story: Mingicing sometimes doesn’t matter the cryptocurrency.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.