Context for Chatgpt:

The Tron network and its native Krypto TRX have won considerably in traction in recent months, while most of the same corners, including Duge, will lose their popularity.

This movement is a key moment for the Blockchain Tron network, which is also preparing for the stock market through a reversed merger of $ 210 million.

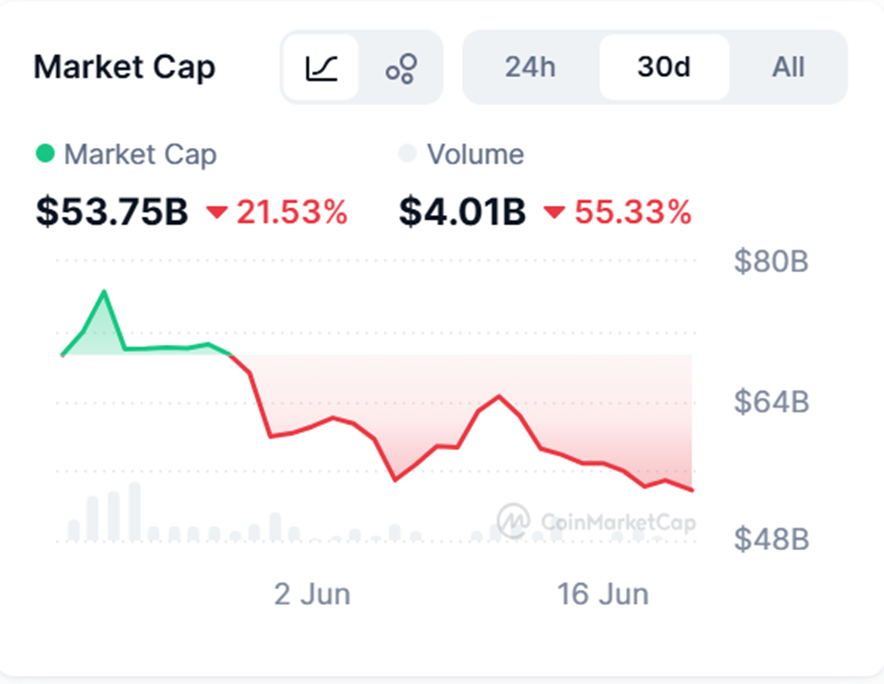

Tron exceeds dogecoin in market capitalization

In fact, this is not the first time Tron has exceeded dogecoin in terms of market capitalization. This happened especially two weeks ago, although it only took a short time.

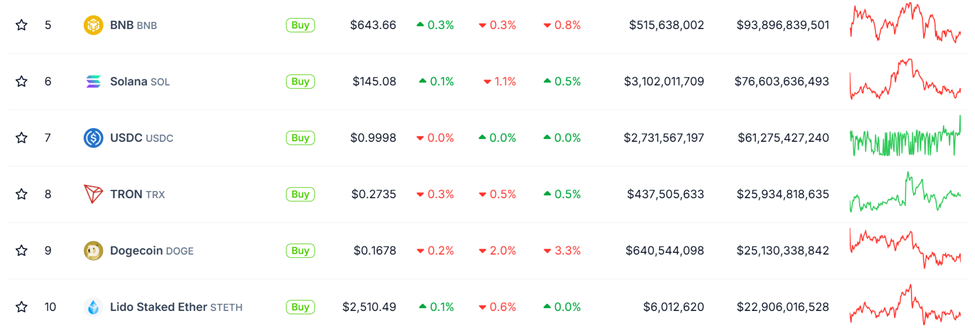

COINGECKO data are currently showing that the TRX market capitalization is $ 25.93 billion, which is much more than $ 25.13 billion in Dogecoin.

This development is governed by an increase in USDT transactions on the TRON network in developing and developed economies. This dynamics gradually strengthens the state of TRON as a basic global payment infrastructure.

“Tron is not just about developing markets. USDT feeds on TRON actual payments both in developed and developing economies. The usefulness of Stablecoins is truly global,” Dao Tron said.

While the TRX course won 12 %since May, Dogecoin dropped by more than 30 %, which was assigned to a decline in interest in the same corners.

In this context, the volume of weekly Duge exchanges decreased by more than 80 %, emphasizing the growing investor’s preference for active workers focused on real usefulness.

In addition, the network is preparing for the stock market through the reversed fusion of $ 210 million. This potential public offers the position of Tron as one of the first major cryptoral payment infrastructures for access to the US capital markets.

Binance stimulates the liquidity of TRON USDT

Cryptocurrency data soon illustrates the size of this application. In particular, Exchange Binance deals daily between 2 and 3 billion USDT in USDT transfers via Tron, which regularly represents more than 65 % of the total USDT activity.

“Binance is by far the main engine of liquidity USDT in Tron Network,” the analytical company said.

In addition, the low cost of Tron and its rapid settlement times has made a privileged selection of stablecoin movements, especially on a large scale.

This effectiveness has also pointed out analysts who now compare the role of Tron in Latin America with the role of traditional payment giants.

“Tron + USDT is also important for payment infrastructure in South America and other developing markets because $ Ma is in the west, or Alipay or WeChat Pay in China. Tron Inc. could be an equivalent of IPO visa for payment infrastructure in Latin America.”

The A-Citizer’s research company has repeated this feeling and noted that Tether and Tron exceed the simple history of developing markets, and developing countries have also strongly based on this duo.

The reaction of the market also reflects this perception change. TRX experienced growing adoption and increased trust in investors, while stories focused on the same corners weakened.

The redistribution of capital to Tron reflects a deeper trend, where traders prefer the usefulness, scalability and liquidity of stablecoins rather than thicknesses.

While Tron goes to its IPO, the renewed momentum of its market capitalization and a convincing claim as a pillar of crypto payments in the real world could support a new increase.

The network is increasingly located as a central element of the global financial system. This change occurs, while the main exchanges, such as binance, create huge daily volumes of USDT on Tron and institutional traders monitor the flows of stable connections as liquidity indicators.

Morality History: Small Tron becomes big.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.