Fidelity says that more BTC comes to an ancient BTC that is not used every day, and that new minors cannot replace them with new parts. Thus, between this trend and acquisitions in the field of business could be the function of bitcoins such as circulating currency in danger.

Does it take on inactive bitcoins?

Thanks to the trend of placing Bitcoins in the whales, there are no assets that keep their assets for years.

However, the crypto industry is now 15 years old and the number of “old” tokens can only increase over time. Fidelity has recently conducted an ancient bitcoins study, of which it has made several key conclusions.

As a reminder, the Fidelity is the leader of the ETF bitcoins; It is therefore natural that this company has a strong interest in performing this research. And at first glance, the idea that 17 % of all bitcoins of the olds cannot be taken lightly.

The company estimates that in this category it is part of 3.4 million BTC, which is more than $ 360 billion. However, Fidelity’s conclusions about mining could prove to be catastrophic:

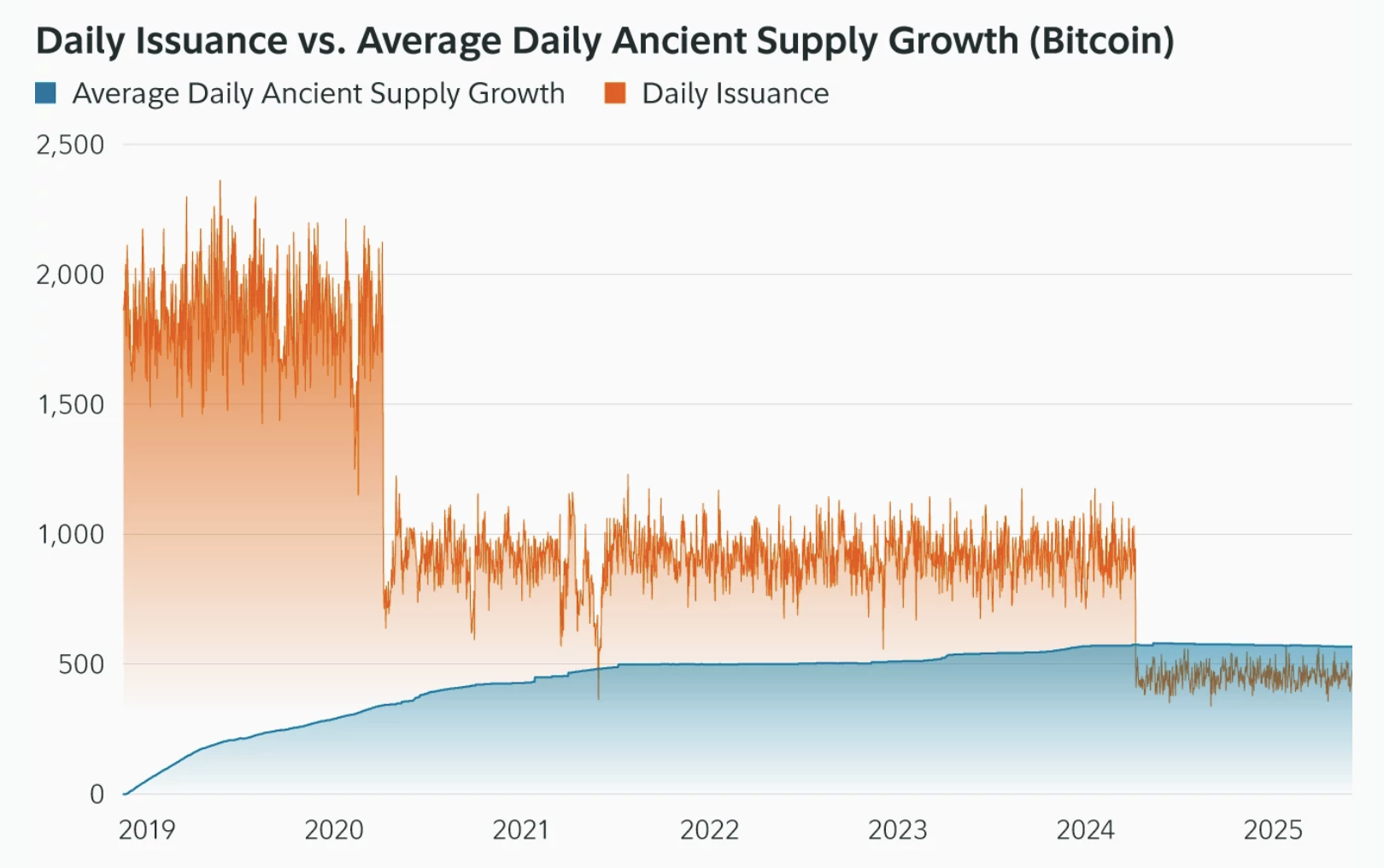

The company said significantly that more bitcoins became inactive every day, that the new tokens are mined. BTC mining industry becomes less profitable and ETF transmitters buy much more BTC than minors cannot produce it.

Fidelity really noted that 566 tokens became “old” every day, while replacing only 450 new ones.

Why “Lost” Ancient Bitcoins

The main concerns relate to the risk that a large part of this old BTC offer is definitely lost due to lost private keys or wallets that have become inaccessible over time. The chain data indicates that approximately 20 % of all mined bitcoins have been irreparably lost.

In addition, more than 1 million pieces are associated with the creator, Satoshi Nakamoto and remains inactive for more than ten years. When the parts are actually lost, the offer in efficient circulation decreases, which changes the dynamics of supply and demand.

A reduced active offer can therefore amplify the volatility of the asset price. And as the Bitcoins’ ceiling is approaching, every further download of the active circulation results in a reduction in available liquidity.

In addition, the risk of concentration increases when fewer parts remain active. Whale crypto can also easily affect the market if the active offer is reduced.

Morality History: A limited offer of bitcoins is good. The offer to reduce bitcoins is sometimes less well.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.