This new key step would allow the platform to join the prestigious “Unicorns” club. In addition, polymarket has recently experienced a revival of the volume of transactions and inscriptions of new users after the closure of the US elections.

The polymarket focuses on the status of the unicorn with a lifting of $ 200 million

According to Reuters, a polymarket is preparing $ 200 million to complete the fundraising fund by billionaire’s financial workers.

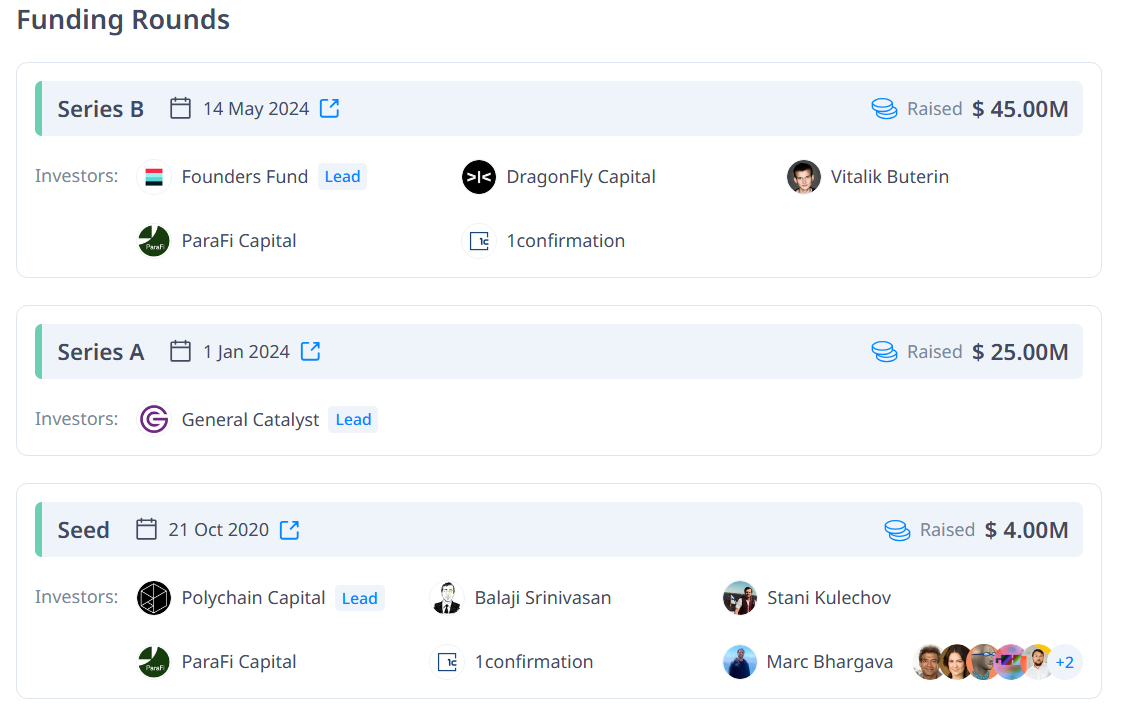

Cryptorank data shows that the polymarket in 2020 and 2024 received $ 74 million. The main investors, including the co -founder Ethereum Vitalik Buterin, supported the future of the platform.

The founding fund led Table B 45 million dollars in May last year. The current tour testifies to the continuous commitment of the fund and its long -term faith in the polymarket.

This new capital should help to expand its infrastructure, improve the development of its products and meet legal challenges, especially in the United States where the platform is currently banned due to gambling regulations.

In addition, its partnership with the social network platform Elon Musk, announced on June 6, 2025, is the key point in the growth strategy of the polymarket.

Thanks to this Agreement, the polymarket is the official partner of the X -Prediction market. Integration thus combines data on the GROK Polymarket Polymarket Forecast and Publications on X and publications on X to offer users more in perspectives.

The partnership strengthens the position of polymarket on the market and allows him to access millions of users around the world.

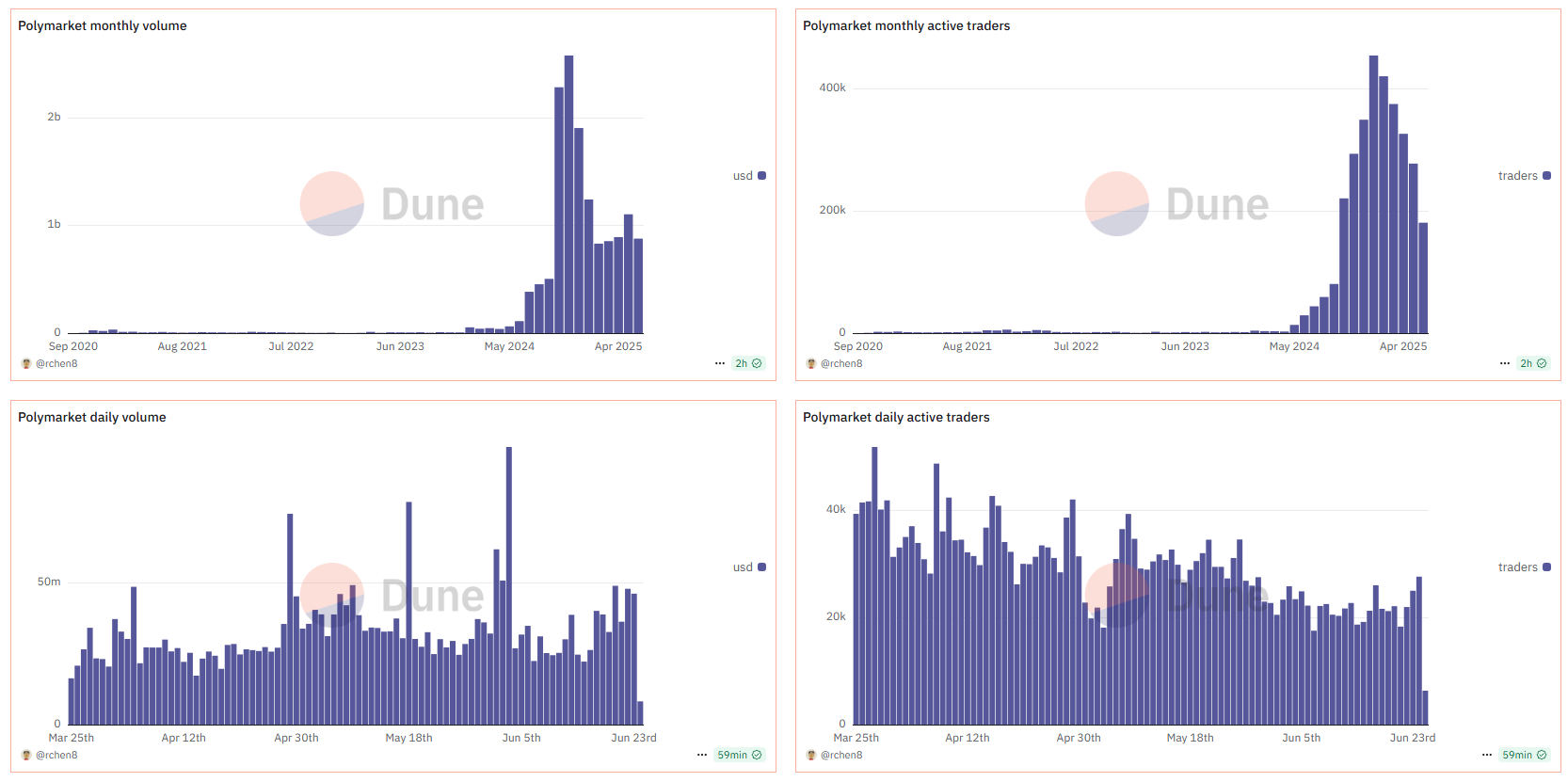

The monthly volume of trading on the polymarket again exceeds $ 1 billion

According to Analytics Dune Analytics, 2025 meant a return on a polymarket with a volume of transactions that exceeded a billion dollars. This monitors the decline earlier in the year caused after election fatigue.

The platform also recorded more than 100,000 new accounts each month and maintained an average daily volume of $ 40 million transactions, with approximately 20,000 active traders.

These recovery reflect the growing community confidence in the potential of decentralized prediction markets. In addition, it takes place at a time when the crypto sector and the whole world are experiencing increasingly important and captivating development.

Although the operation of most cryptocurrencies has decreased, the operation of polymarkets jumped by 50 %, out of 10 million visits in March to more than 15 million in May.

Despite this growth, the polymarket continues to deal with significant regulatory challenges. The American CFTC recently summoned Coinbase to get information about the polymarket. It should also be noted that the polymarket is inaccessible to US residents from 2022 after regulation of $ 1.4 million with CFTC for the operation of an unregistered trading platform.

In addition, polymarket in France encountered legal problems for violating the laws on gambling associated with prediction markets. Moreover, some people believe that large investors can manipulate market prices and raise questions about the neutrality of the platform.

Morality of History: Chase the mare and she returns in a unicorn.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.