This change could be a real challenge for the crypto market. In fact, as the likelihood of interest rates decreased decreases, cryptocurrencies could potentially become less attractive for investors.

Crypto in the face of new risks face to face reduced chances to reduce feed levels

Employment report in the United States, published by the Labor Statistics Office, revealed that the unemployment rate dropped to 4.1 %compared to 4.2 %in May and is below 4.3 %of the forecast.

“The unemployment rate in the United States dropped to 4.1 %in June, the lowest since February. It remains significantly below the historical average of 5.7 %,” wrote Charlie Billo.

Employers in the country of Uncle Sam added 147,000 jobs in June. This is in line with the average number of jobs added every month in the previous year (146,000).

The industry that was supposed to grow on jobs in the state government and health. On the other hand, the federal government experienced cuts.

“92 % of 147,000 jobs allegedly created in June concerned government, health or social services. Manufacturing industry continued to lose jobs. These unproductive jobs increase our business deficits and cause more public debt and higher inflation. Investors will not be deceived forever.”

Despite the criticism of the bond market, it responded rapidly. After publishing the report, the revenue of state accounts after 10 years climbed to 4.36 %. But why?

Because the economy is doing well, investors are less worried about the future and are ready to invest in safer options such as the United States government duties. Since more people buy duties, interest rates (income) increase.

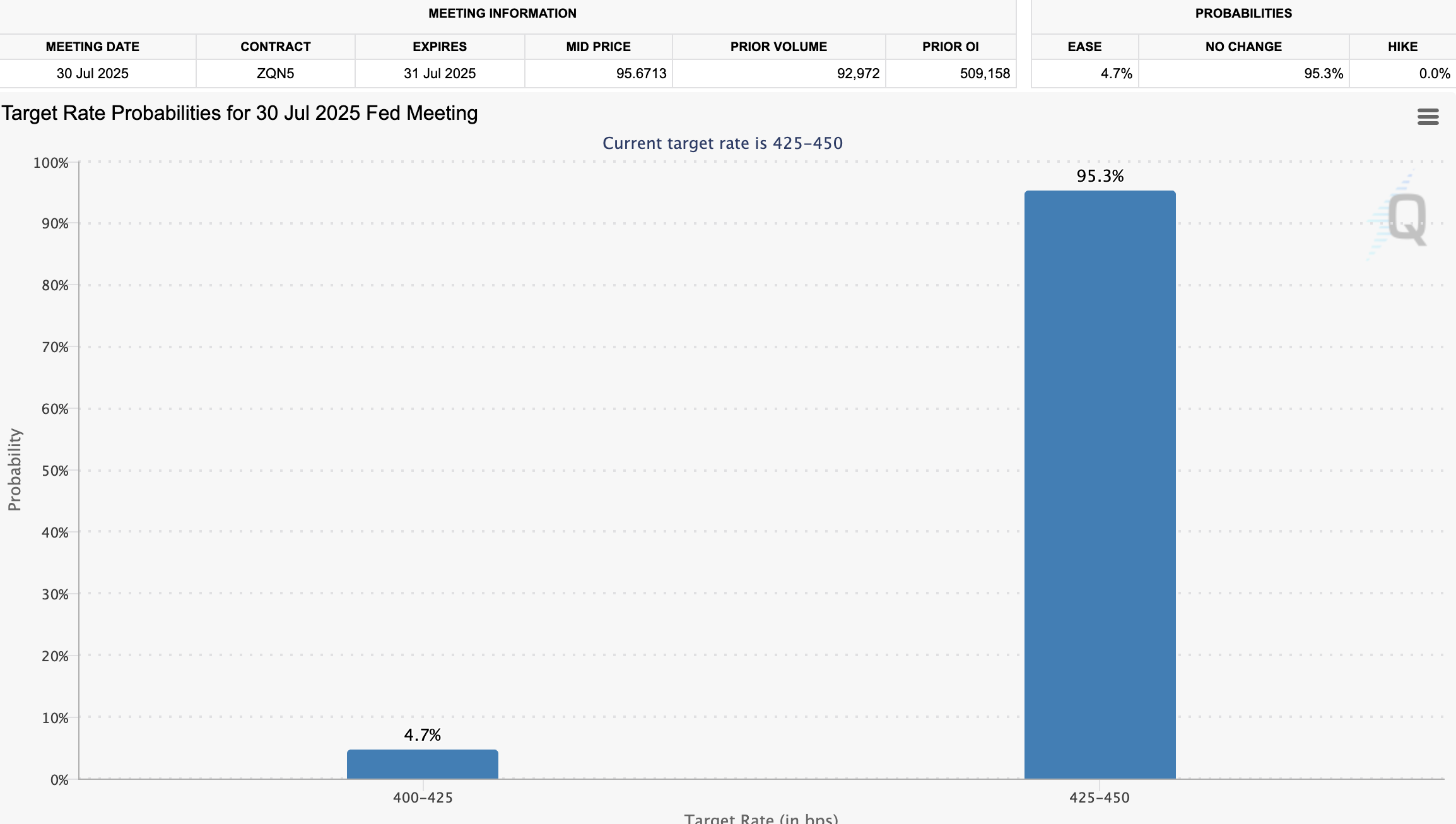

In addition, these solid economic indicators suggest that the federal reserve system could have less interest rates in July. This change was illustrated especially by the CME Fedwatch tool. The probability of dropping rates in July dropped to 4.7 %, compared to a chance to 25 % earlier.

“The chances of dropping Fed rates in July have collapsed, from 25 % to less than 5 % overnight. For what? Inflation due to rising prices and surprisingly solid job reports keeps the Fed at the moment.

Since December, the federal reserve system has maintained stable interest rates between 4.25 % and 4.5 %. This aroused criticism from President Trump, who even threatened to release President Fed Jerome Powell. But Powell lasted.

In parallel, this change in expectations of rates could create the opposite winds for the crypto market. Higher interest rates cause traditional investments such as obligations, more attractive, potentially divert the attention of risk assets such as cryptocurrencies. Therefore, a reduction in demand could consider the price.

Despite the challenges in the current economic environment, several bull catalysts remain for the market, especially for bitcoins. According to Cryptosrus, the global cash offer recently climbed to $ 55.48 billion. In addition, the US dollar has experienced the worst performance in the first half of the year since 1973.

According to Kalshi, a prediction platform, the total debt of the United States should reach an amazing amount of $ 40 billion this year.

Therefore, the increase in state debt and concerns about inflation and government expenditure could be BTC more attractive as coverage.

“In parallel, bitcoin graphics are fixed by $ 170,000 and know what is approaching. The currency tubing is located. BTC focuses on release speed,” Cryptosrus said.

Although traditional financial systems are under pressure, bitcoins and other digital assets could offer attractive opportunities for investors who try to diversify and protect against economic instability.

Morality of the story: Feed Silent, Silent Bitcoins.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.