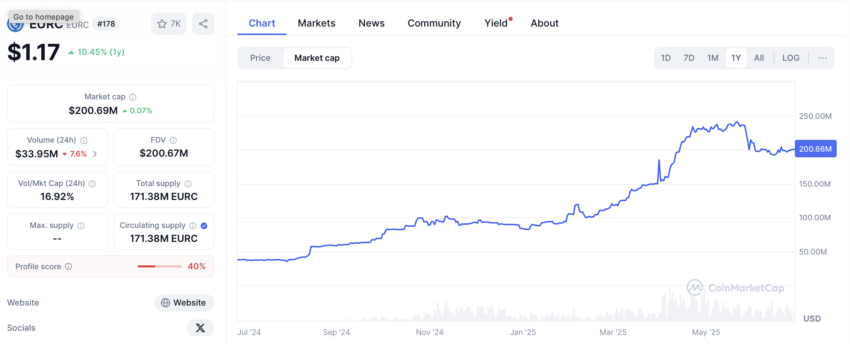

Stablecoins leaning on Euro exploded in 2025

The year 2025 means tearing the trend for stablecoins supported by the euro with a global capitalization of $ 500 million, which is more than 30 % since January. Behind this growth of Circle EURC de draws the dynamics itself, while the offer in circulation has more than doubled in six months. Its rapid integration on Ethereum, Solana and the base made it possible to capture both the activity of the native Krypto and the activities of institutions looking for a regulated alternative to the tokenized dollar.

At the chain level, traction is visible. The volume of EURC monthly transfer now exceeds $ 2.5 billion, while the number of active portfolios increases at a permanent pace (+66 % since January). EURC is now integrated into the main protocols of Defi: used as collateral in Aave, exchanged for Uniswap and Curve and already included in structured products denominated for the euro. The token procedure is not performed by the announced effect, but by real and measurable use.

The rise of EURC is not only explained by compliance with the shepherd. It is also part of the macro context favorable to the euro. The European currency is clearly appreciated against the dollar (+12.88 % since the beginning of the year), while the Fed remains careful about its main rates. This cash divergence feeds on the strategic relocation of investors to the euro, even in the ecosystem crypto. Result: We are witnessing partial migration of liquidity on the EURO-NATIF assets, so far marginal.

Structural pivot? Not yet

Despite the Bull’s dynamics of EURC and tokens, such as EURS or EURT, the dollar domination remains stunning in space of stablecoins. Currently, more than 90 % of the Stablecoins global market capitalization remains supported by a greenback, with almost unsurpassed progress in terms of market depth, liquidity and trust. The USDT and USDC themselves accumulate more than $ 230 billion, compared to a hard time for all stablecoins in EUR.

The heart of the global crypto liquidity remains supported by the dollar. Liquidable funds, volume of trading and arbitration between chains are largely dominated by USDT and USDC. Even in the euro area, the Defi platform continues to prefer dollars marked in dollars for insufficient depth on the EURC side. The historical weight of the dollar in the overall replacement is mechanically translated into the mechanisms of the I-Redeece.

It is true that the mica frame creates a favorable soil for a fixed Euroreference stable, but the question is not only regulatory. It is also behavior and structural. As long as the Defi actors are looking for liquidity, the speed of implementation and integration with multiple Chahones that are already running, the euro -supported stabbecins remain secondary. EURC sets the basics of trustworthy alternatives, but to replace the dollar, it will be deep changes in the paradigm; Not only favorable gatherings.

Morality of History: The dollar rules, but the euro is preparing a coup … Blockchain version.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.