Context for Chatgpt: In 2025, while Bitcoins accumulated record heights, the altcoin market tried to get out of its stagnation phase, resulting in a debate on deep restructuring the market crypto.

In parallel, access to the purchase and “Hobling” altcoins has failed, because the domination of Bitcoins (BTc.D) has been increasing for two years.

Why go from the purchase and binding of altcoins to disciplined trading

StockMoney Lizards, a well -known investor X, faced generalized losses among altcoins traders, shared a simple strategy designed for those who have limited experience. The named “Low Qi Altcoin” strategy consists of four main steps:

- Select renowned altcoins: Focus on parts that have shown their resistance in several market cycles, including Sol, ADA or ETH. These parts generally have stronger bases and lower risk than new smaller projects.

- Carefully assign capital: Divide business capital into five same parts and distribute the risk at different purchase points.

- Define clear entry points: Enter the position when the daily RSI drops below 30 (occurrence signal). After each new price decline, continue with 10 %compared to the last purchase.

- Set strict output points: Once the profits have reached 30 to 50 %, get out of the entire position. Avoid hesitation or waiting for even higher profits, as altcoins markets remain very volatile and vulnerable to sudden whale movement.

StockMoney Lizards stressed that this method does not promise rapid wealth, but its goal is to help traders avoid loss of everything, as for most Altcoin investors. It also recommends reinvesting half of the profits on stablecoins and the other half in bitcoins for long -term accumulation.

“You won’t get rich quickly. But you won’t lose everything like 99 % of Altcoins (…), this boring strategy is exactly how I survived my trading,” StockMoney Lizards said.

Michaël van de Poppe, CIO and founder MNFund also emphasized the current mistake: many investors are in a hurry to purchase only when prices have already climbed, which increases the risk of loss.

The disciplined method designed by StockMoney Lizards helps reduce the risk and reduce the mentality of FOMO described by Michaël van de Poppe.

Knowing how to maintain a good discipline may be difficult because many traders still hope for quick and important profits.

“(This is not a strategy that most people believe in crypto, but the one they need. They wanted this lambo yesterday,” another investor at X.

Altcoins period for the second half of 2025?

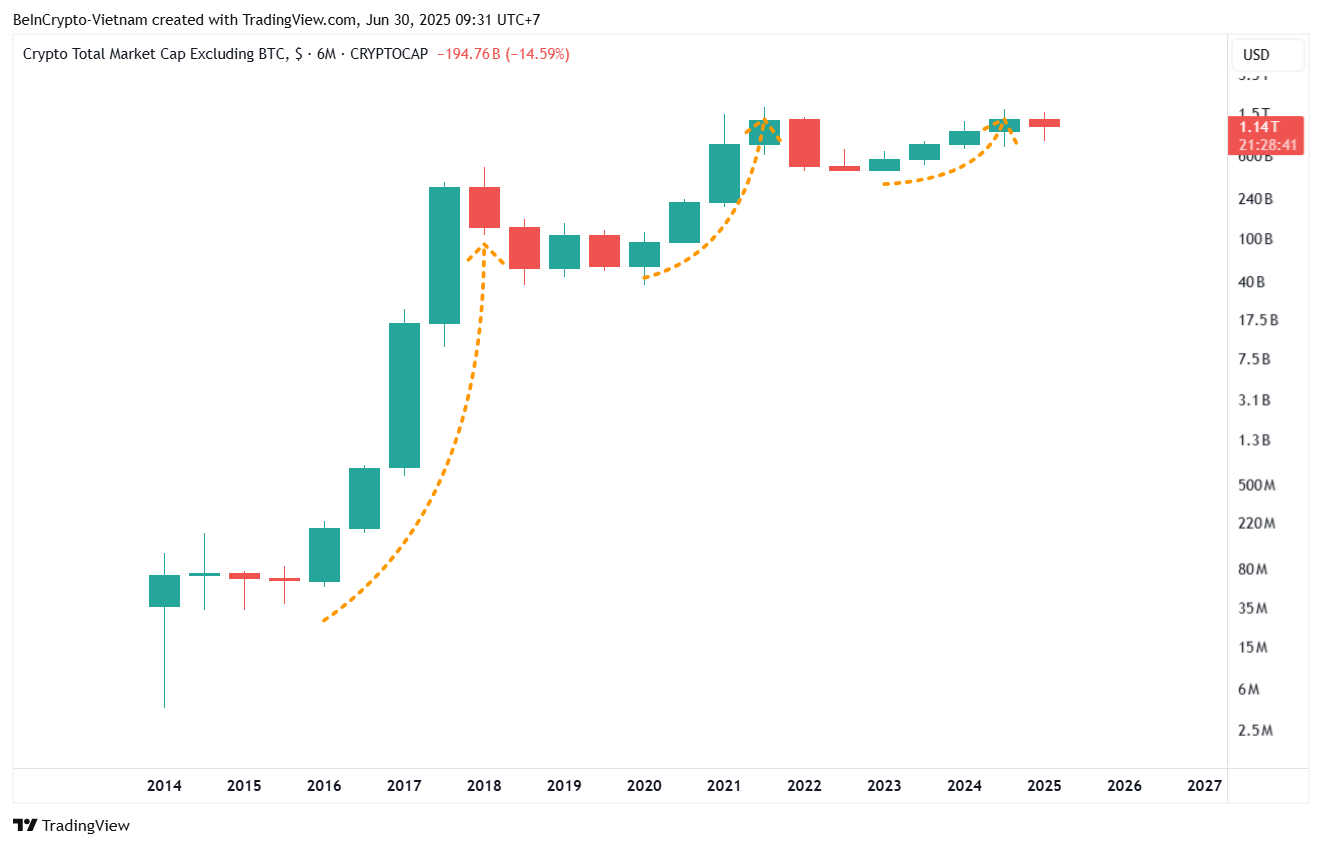

The recent report of the English team team has identified the inscriptions to prosecute the winter of altcoins. Analysis of the Altcoin market (total 2) in a six -month chart shows that Total2 has completed four consecutive green candles, and now it seems to enter the red candle phase.

In previous cycles, four six six -month candles ended with two red candles, indicating that the second half of 2025 could remain difficult for altcoins.

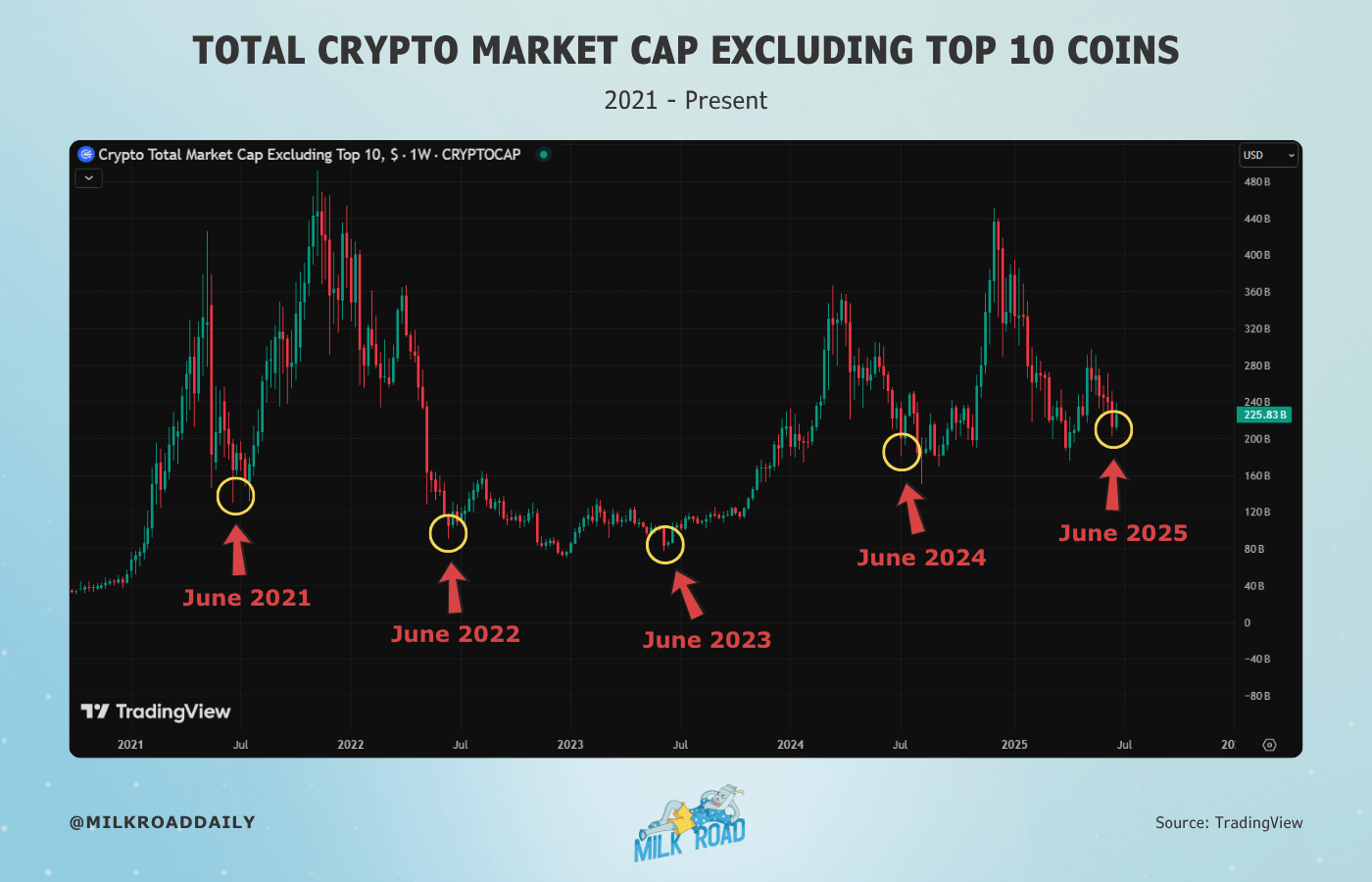

However, the investor’s milk road observed a more optimistic historical scheme: the cavity of the capitalization of the altcoin market, with the exception of the top 10, often creates every year in June.

“Every month in June since 2021, he described a key break on the Altcoin market (…) and June 2025 could follow the same way,” Milk Road said.

This prospect is also supported by other investors who hope to capitalize the Altcoin market at the end of 2025.

The contradictory signals from different data models add uncertainty to forecasts for the second half of 2025. At the same time the domination of Bitcoins (BTc.D), which must generally refuse to report the season of altcoins, remains above 65 %.

Finally, altcoin investors remain divided. Some seek to adjust their expectations and strategies after previous losses, while others continue to wait for great revenues to justify years of detention.

Morality of History: Nothing will ever get in altcoins.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.