Context for Chatgpt:

After a considerable revival of popularity in the spring, the XRP, the flag crypto of the Ripple Company, is uncertain between growth and relapse.

The technical assessment of the graph of the last five days of XRP offers us a greater context in these views of analysts.

Analysts remain carefully optimistic about the XRP course

The XRP price has dropped by almost 7 % over the last week due to the growing geopolitical tension, especially caused by American air strikes on Iranian nuclear installations. Altcoin got from approximately $ 2.20 per cavity nearly $ 1.90 before stabilizing around $ 2.06.

Famous trader Peter Brandt emphasized the potential head and shoulder scheme (H&S English Head and shoulders) on graphics XRP. It is usually a reduction in the indicator that signals a reduction in the trend of reducing direction ascending if the key support level is lost.

Brandt, however, also calls for caution in the face of premature shelter conclusions. It openly notes that it is important to maintain XRP support over $ 1.80.

The decisive weekly fence under this critical level would therefore be necessary to confirm the scenario down.

In parallel, analyst Egrag Crypto presented in detail the ascending perspective using several technical indicators.

In particular, Gauss Canal is an indicator of volatility used to identify the power of trend and potential twists. The fence inside this channel limit, currently around $ 1.75, could point out the weakening of dynamics and possible pressure down.

Egrag underlines the importance of maintaining XRPs above this limit to maintain ascending force.

In addition, EMA for 21 weeks acts as a critical mobile average that traders use to identify macroeconomic trends.

So the fence above the EMA level of $ 2.33 would be a sign of strong dynamics ascending.

In addition, 2,65 $ resistance would be confirmed by a long -term robust ascending trend.

Egrag also applies an analysis of elliott waves, a technical approach that identifies recurring patterns (waves) at market prices to provide potential goals.

The use of the Elliott Waves ratios therefore expects an XRP to be able to reach $ 9 to $ 10 if Altcoin successfully completes his fifth awaited wave, assuming that the current level of support remains solid.

Short -term technical analysis: recommended caution

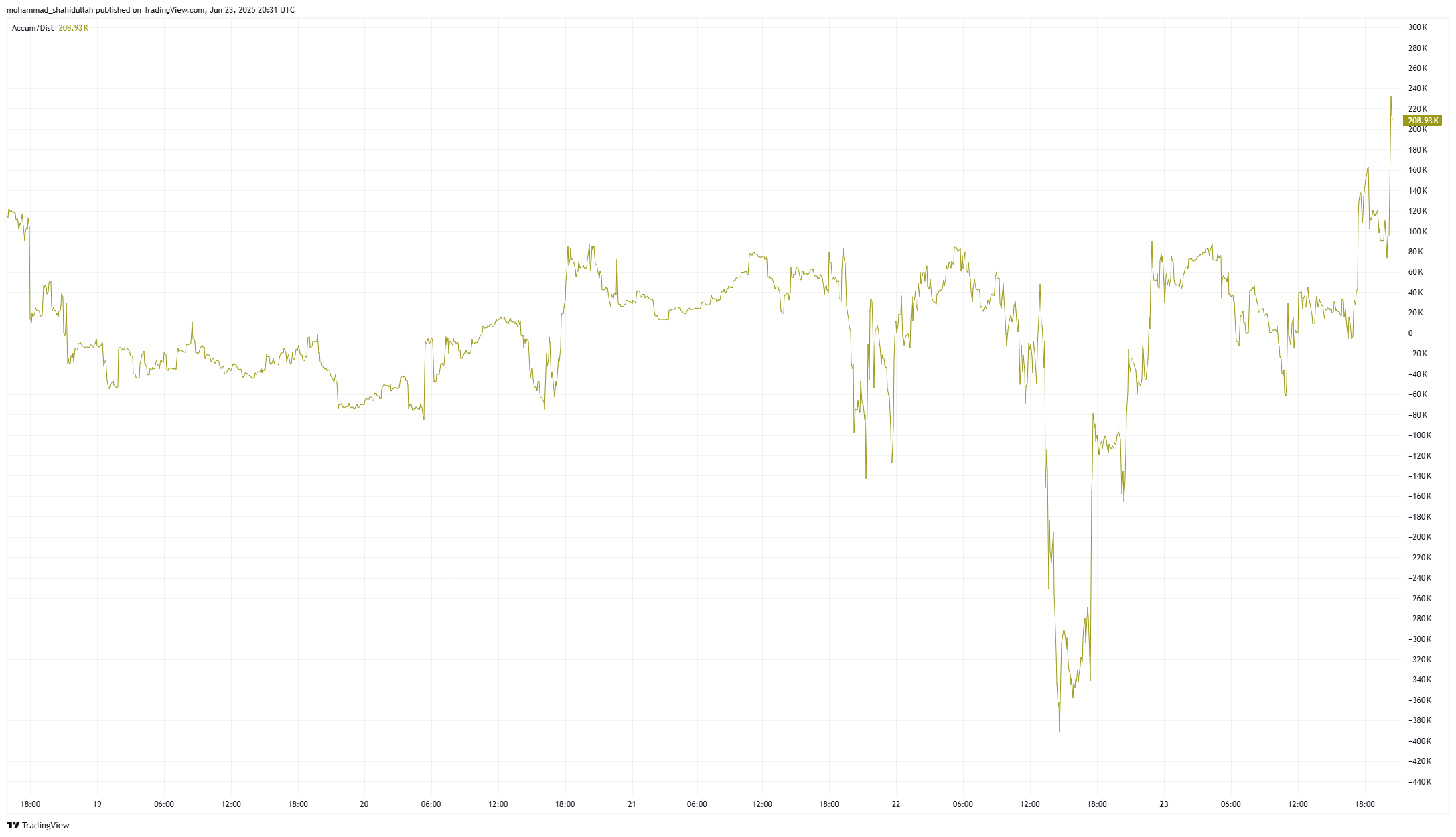

The price of the crypt ripple faced high sales pressure, with a sudden drop in price to $ 1.90, confirmed by an accumulation/distribution line (A/D) that has fallen significantly.

A/D line pressure on purchase and cumulative sale; Its decline suggests a higher volume of trading during prices, reflecting the strong activity of sellers.

Although the XRP price reached almost $ 1.90, the A/D line has stabilized and a slight increase began during the reflection, indicating the restored buyers’ activities.

However, accumulation has not yet neutralized previous distribution during this reflection and therefore suggests that some caution remains fine.

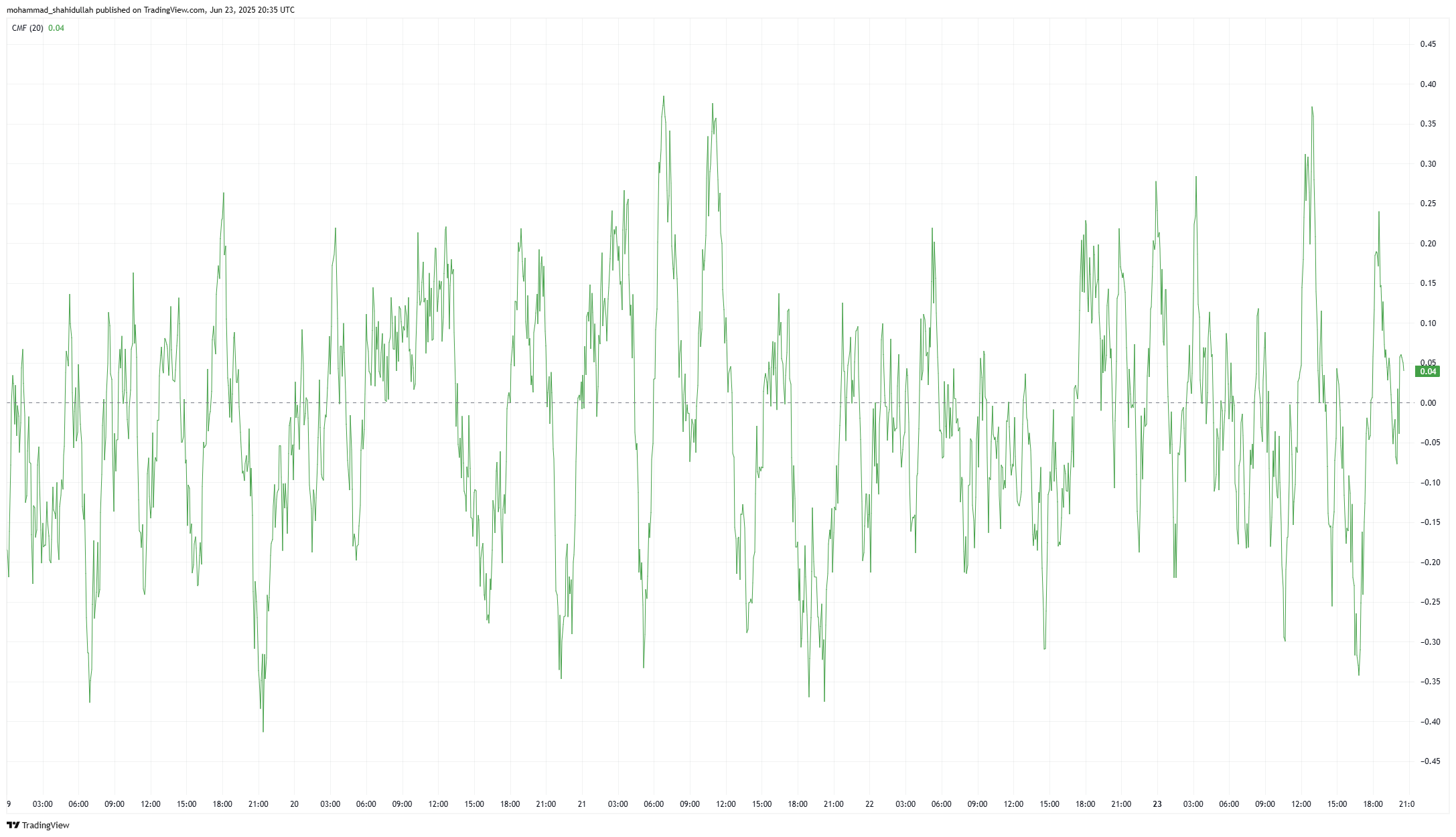

In parallel in parallel, the money indicator of Chaikin Money Flow (CMF), which shows the power of cash flows entering or from the assets, fired negative during the sale, confirming the strong capital outputs.

Although the CMF has improved somewhat during the XRP, it remained weak and did not enter a positive area, indicating that the buyers remain hesitation.

Consolidation and critical levels to monitor XRP

These technical indicators indicate that XRP is currently in the phase of cautious consolidation. Although the support of nearly $ 1.90 has proved to be a fixed, limited improvement in CMF indicates the persistent uncertainty on the market.

Overall, this analysis is in accordance with the views of analysts, according to which key support of approximately $ 1.75 to $ 1.80 remains intact. Only the decisive weekly fence under these supports would confirm the lower perspective.

Traders should therefore carefully monitor the interaction of XRP with critical levels of support and resistance.

More precisely, an ascending breakthrough confirmed over $ 2.33 and then $ 2.65 would indicate an ascending sequel, while the decisive loss of support to $ 1.75 -1.80 would indicate an increased lower risk.

Morality History: A decrease of XRP is not a bear.

Notification of irresponsibility

Notice of irresponsibility: In accordance with the Trust project Directives, this article for price analysis is intended only for information purposes and must not be considered financial or investment advice. Beincrypto undertakes to provide accurate and impartial information, but market conditions may change without prior notice. Always carry out your own research before making any financial decision and consult a professional.